CARE FOR ALL [PART 3]

Selecting a medical plan: what to know about the different types

Medical plans are often categorized by network access and referral requirements, and HSA or HRA access.

Know what the different plan types mean so you’re ready when it’s time to make a plan choice.

Network access and referral requirements

Network access and referral requirements

HMO

Health Maintenance Organization

HMO

Health Maintenance Organization

Doctor/provider choice

In-network only except for true emergencies May be required to use insurance-owned facilities (like Kaiser)

Primary care physician (PCP)

Must select your specific primary care physician or one might be selected for you

Seeing a specialist

Insurance requires a referral from your primary care physician

EPO

Exclusive Provider Organization

EPO

Exclusive Provider Organization

Doctor/provider choice

In-network only except for true emergencies

Primary care physician (PCP)

A primary care physician selection is generally not required

Seeing a specialist

Insurance usually does not require a referral from your primary care physician, but the specialist might

POS

Point-of-Service

POS

Point-of-Service

Doctor/provider choice

In- and out-of-network care

Primary care physician (PCP)

A primary care physician selection may be required

Seeing a specialist

Insurance often requires a referral from your primary care physician

PPO

Preferred provider organization

PPO

Preferred provider organization

Doctor/provider choice

In- and out-of-network care

Primary care physician (PCP)

A primary care physician relationship is encouraged, but not recorded by the insurance company

Seeing a specialist

Insurance often does not require a referral from your primary care physician, but the specialist might

HSA or HRA access - (all plan types above may come with either an HSA or HRA)

HSA or HRA access - (all plan types above may come with either an HSA or HRA)

| Type & definition | What to know |

|---|---|

HRA | •The HRA is tied to a specific medical plan •Your employer sets aside a specific dollar amount for you to use towards qualifying medical expenses |

| HDHP with HSA | HSAs come with a qualified HDHP (sometimes called CDHP). These plans: •meet minimum deductible and maximum expense requirements •only cover preventive care before the deductible is met •usually cost less (have lower premiums) than other medical plans |

Only you can decide which plan type is best for you.

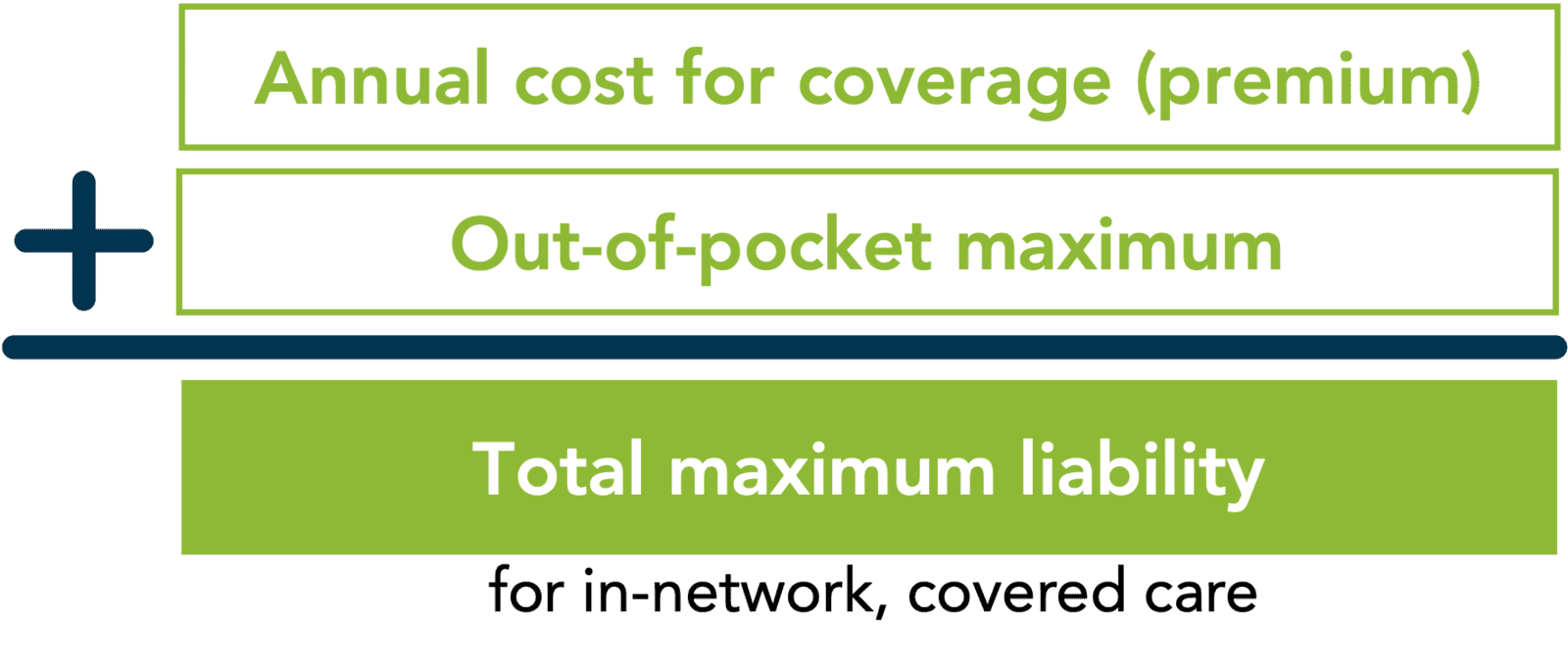

Along with these items, consider adding your annual cost for coverage (premium) to the out-of-pocket maximum for each plan to get your total maximum liability for the year.